The trans-Pacific market share of NVOs has increased during the pandemic, reaching nearly 4.73 million TEU in US imports. BCOs’ fallout with ocean carriers and their demand for fix-rates are believed to be the reasons.

As JOC.com reports, despite the disruptions on the market due to COVID-19, non-vessel operating common carriers (NVO) have handled 47% of eastbound trans-Pacific volumes up until August. Even though this is still 2% less than the volumes handled in the same period of time in 2019, NVOs have shown a steady upward throughout the entire 2020. The market share of NVOs is currently at the highest level at least in the past 5 years.

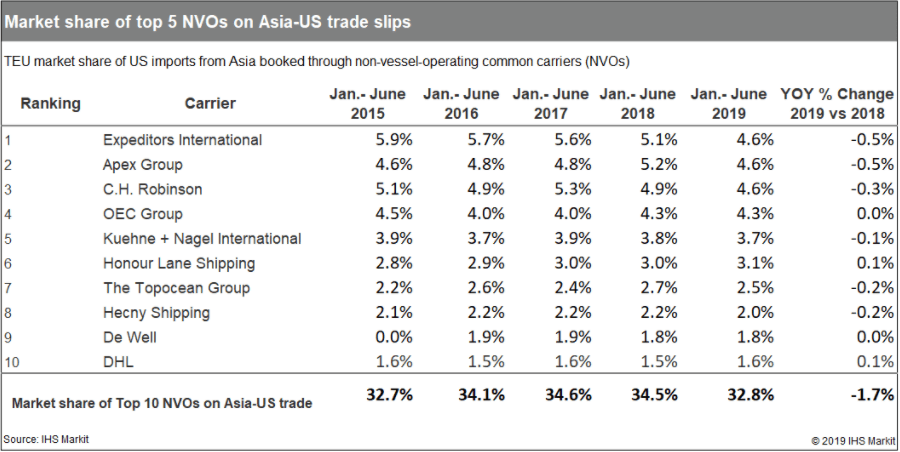

If we look at the following analysis of how the NVO market share developed between 2015 and 2019, it shows that the combined market share of the top five NVOs has fallen from 24% to 21.8%, while the combined market share of the next tier of NVOs (ranked 6 through 10) increased from 8.7%to 11%.

Data was then suggesting that smaller sized NVOs were doing much better. And again in 2020, some of the major NVOs have reported a considerable slip. While relatively new, and mostly Asian-based ones doubled their share in Asia-US imports.

The data from PIERS shows that the largest decline in 2020 was registered by De Well Orient Star Transport, which lost around 16% of trans-pacific shipments. MCL Multi Container Line and DB Schenker both went down 15.3% compared to last year, as well.

But on the other hand, a newcomer on the market, such as Flexport saw the biggest increase with 135% during this period. Hong Kong-based DT Logistics shows the upscale with 35.5%. DFDS Group is up 20.5%, Joosung Sea & Air Co. – 19.6%. Followed by Safround logistics with 15.4% and Honour Lane Shipping – 12.6%.

So, did NVOs benefit from the pandemic?

Even though COVID-19 has shaken the industry, the current trans-Pacific market dominance of NVOs can actually be attributed to the pandemic, according to maritime experts.

FreightWaves was reporting about the increased US import demand (that outpaced the capacity) and therefore, climbing high rates already back in August; The demand was not surging despite Coronavirus, but because of it.

Some of the e-commerce merchandise moves in less-than-container load (LCLWhat is less than container load? Less than container load (less than container load, LCL) is a shipping term that refers to the delivery of cargo in smaller quantities than a full container load. A f... More) shipments, which NVOs specialize in handling. So, when the demand for online shopping increased NVOs found more clients. Because this time, they had not only better services, but better rates to offer.

Carriers vs NVOs

Major carriers were registering month to a month volume decline in the first 5-month period of 2020. Total trade in and out of the US went down 8.3% during this period.

On top of that, the decision of Beneficial Cargo Owners (BCO) not to sign deals with carriers during springtime to keep fixed rates, as they usually do, made the situation more unstable for them. BCOs chose to hold off on signing contracts because spot rates were low and predicted to dip further.

NVOs, regardless of what BCOs did, signed fixed-rate contract deals with the carriers in April. And when in Summer, ocean carriers cut the capacities and increased the spot-rates as demand picked on the trans-Pacific, that’s when NVOs offered better booking deals and rates to BCOs than carriers could. BCOs started shifting volumes to the NVOs at cheaper rates.

Back in June predictions suggested that as the time goes on, carriers will begin going back to BCOs. Offering them more competitive short-term fixed-rate contracts. But despite how the process might develop in the future, with a highly beneficial Summer, NVOs are dominating the China-US trade lane.

Digitally deficient NVOs are at threat

NVOs might be able to offer various services and cut better deals with the ocean shipping lines, market giants are not always satisfied with the tough competition. For example, Maersk’s latest strategy to integrate Damco into its service offering gives players on the market a new concern.

Damco brand’s Air and LCLWhat is less than container load? Less than container load (less than container load, LCL) is a shipping term that refers to the delivery of cargo in smaller quantities than a full container load. A f... More (Less than Container LoadWhat is less than container load? Less than container load (less than container load, LCL) is a shipping term that refers to the delivery of cargo in smaller quantities than a full container load. A f... More) offering will combine with Maersk’s logistics and services to complement its end-to-end offering. It tries to eliminate the need for intermediaries such as freight forwarders/NVOs.

The former global CEO of DHL Global Forwarding, Roger Crook suggests that carriers should consider building their own end-to-end offerings. Because with huge privileges, by getting into the freight forwarding business, Maersk may also place pressure on the prices.

So as predictions go, in time, freight forwarders and NVOs will have to rethink their digital strategy and innovate to endure market developments.